An Illusion of Affluence

October 10, 2020

In 2019, a typical new physician started practice with $200,000 in education debt. That new doctor’s higher income is partly an illusion, because it ignores the practical necessity of paying off medical school debts (the interest of which is not tax-deductible) with earned income taxed at a federal marginal rate as high as 37%.

But most Americans believe that all doctors are rich, and so do some doctors. Primary care doctors might conclude that it’s the specialists making higher incomes, living in big houses and driving fancy cars, who are the rich doctors. Specialists may agree, at least until they consider the hedge fund manager with the twenty-acre horse farm down the road.

But focusing on houses, cars, vacations, or dining out misses the point on real wealth.

Of course a specialist physician earning $350,000 per year can sustain a more expensive lifestyle than a primary care doctor earning $200,000, who in turn can spend more than a public school teacher earning $75,000. But measuring wealth solely based on current lifestyle ignores the profound challenge of maintaining that lifestyle after retirement.

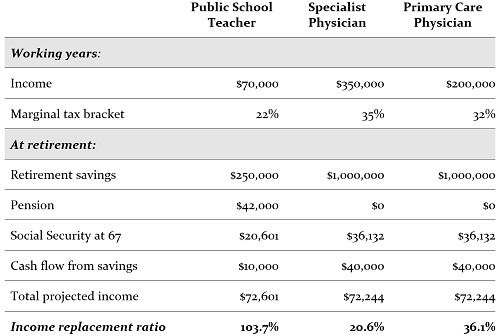

There is a dangerous gap between the perception of “rich doctor” and the reality of “financially at risk” throughout a doctor’s career, and never more so than at the retirement transition. To see why, let’s compare the finances of a retiring public school teacher with those of two physicians at the same age:[1]

The teacher retires with a modest $250,000 in investments, but in addition, he'll receive both Social Security and a pension benefit.[2] He might not need to withdraw anything from his portfolio to duplicate the after-tax cash flow he received while working.

In contrast, that specialist physician can expect to receive the maximum possible Social Security benefit of $3,011 per month ($36,132 per year) at age 67—but that will replace less than 10% of her pre-tax income during her working years. She won’t get a pension. She will need to rely heavily on accumulated assets to produce cash flow, but her lifetime accumulation of investment assets equals less than three years of her pre-retirement spending. In terms of the funds needed to sustain her lifestyle in retirement, this is a disastrous shortfall. Assuming a sustainable withdrawal rate of 4% boosts her income replacement ratio to just over one-fifth of her income.

Still, compared to most Americans, that physician is rich. Really rich. In fact, having a net worth of $1 million places her in the top 5% of all Americans. If we assume she owns a home and other non-financial assets, she’s richer still.

Especially as they approach the retirement transition, the perception of “rich doctor” versus “middle-class teacher” is economically backwards. It is the teacher, not the physician, who is better equipped to maintain his lifestyle; it will be the physician who must sharply curtail her spending in retirement.

How about the primary care doctor? A status measure of success—what he can afford to spend while he’s working—suggests he’s not nearly as rich as the specialist, though far richer than the school teacher. But a retirement cash flow measure tells a very different story. Social Security and cash flow from his pre-tax retirement plan will replace about one-third of his income, significantly more than the specialist’s one-fifth.

But wait a bit. Do these physicians really need to keep spending such remarkably high incomes—both in the top 5% of earnings for all Americans—once they retire? Isn't it perfectly acceptable to expect to spend less in retirement than you earned while working?

The answer is complicated. Consider Warren Buffett. In 2019, he's 88 years old. He lives in the same house he bought in 1958. He dines at Gorat's Steak House in his hometown of Omaha, Nebraska, where his favorite 22-ounce T-bone cost $48. With $80 billion in net worth, saying he can comfortably afford his lifestyle is one of the world's great understatements. He could even order two appetizers if he wanted to.

So what is the relationship between your earnings while working and your desired income once retired?

What you’ll want to replace once you retire is not what you earn, but what you habitually spend. Note well the choice of words. You'll want to maintain your lifestyle, but you need not fully replace your income. Here’s a first hint at a strategy to get your finances back on track: by intentionally managing your lifestyle while working, you can make it easier to maintain that lifestyle after retirement.

Imagine two cardiologists, each earning $350,000, a net of $250,000 after taxes, benefits costs, and retirement savings. One spends all of his $250,000 after-tax income every year, saving nothing to after-tax investment accounts. He will be faced with some unpleasant lifestyle adjustments once he stops working.

His partner in the same practice spends only $150,000 and saves the rest. She’ll need perhaps $200,000 of pre-tax income in retirement ($150,000 after-tax) to preserve her lifestyle, and she’ll have a much larger pool of investment assets to provide that cash flow.

Whether you’re a physician just starting out or a late-career doctor cutting your hours as you ease toward retirement, you may not be as rich as you—or your neighbors—think.

Our point is simple. At the end of their careers, as at the beginning, much of the apparent wealth of doctors is an illusion. Don’t let the illusion of wealth distract you from building the real wealth you’ll need to live the life you want for decades after you retire.

We’re assuming that both the teacher and the doctor are unmarried, to simplify the projections of their pension and Social Security payments. We’re also assuming no growth of income and no inflation, to make the retirement income numbers as comparable to current income in the working years as possible. Finally, we’re using a sustainable distribution rate in retirement rate of 4% of savings.

Less than 15% of Americans can look forward to pensions when they retire, with most of those working in the public sector.

- Log in to post comments